MVP Oscillator

The Main Ribbon

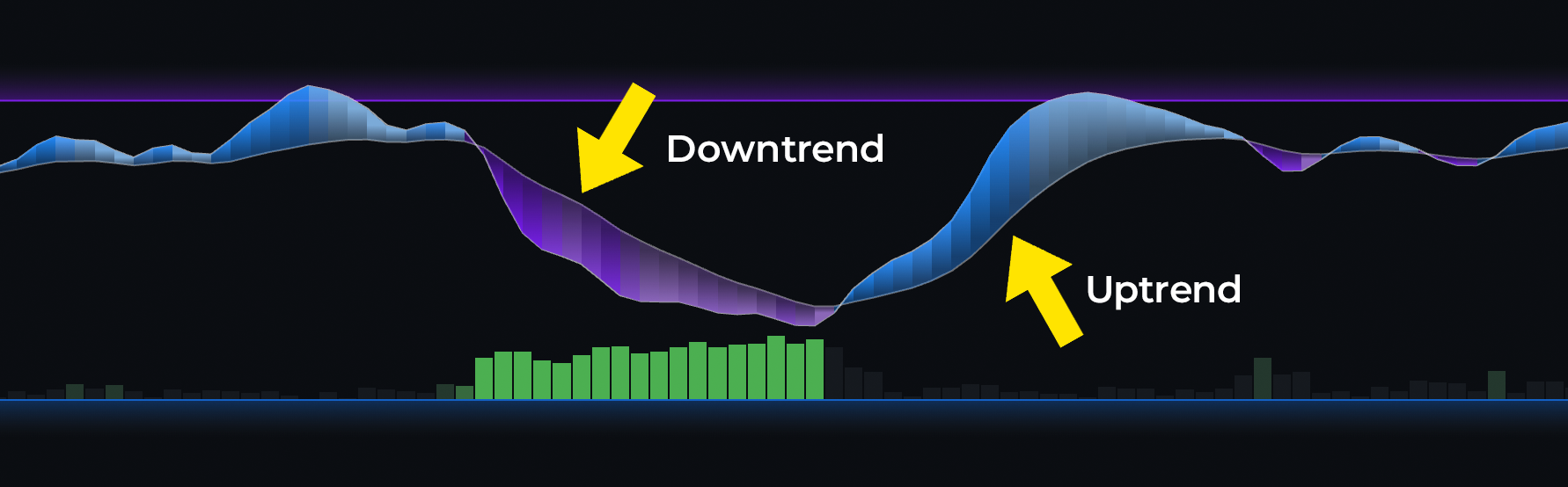

This oscillator analyzes market trends and produces a blue and purple ribbon. A blue ribbon suggests the market is moving upwards, while a purple ribbon indicates the market is moving downwards. This plot can be used classically, allowing users to easily identify divergences. However, in this mode, divergences are not the main feature and must be identified manually.

Ranging between -100 and 100, this oscillator indicates a bearish market and downward movement when below 0. Conversely, when above 0, the market is in a bullish state. Looking for confluence is key. For example, if the oscillator is below 0 and purple appears on the ribbon, this could be a stronger indication that the market will continue to move downwards. However, if it is below 0 and the oscillator turns blue, this could signify indecision in the market.

|

|---|

| The Main Wave on the MVP Oscillator |

Monitoring when the oscillator becomes overbought or oversold can also provide valuable trading insights. The blue and purple overbought and oversold lines indicate when the oscillator may be more likely to experience a reversal. For example, if the oscillator is at -100, we may expect a reversal and bounce. If it is at or approaching 100, we might consider shorting the market as a potential bearish reversal may be imminent.

Before trading a overbought or sold bounce; try to wait for a confirmation e.g. a crossover the oversold level or crossunder the overbought level.

The Green Bars

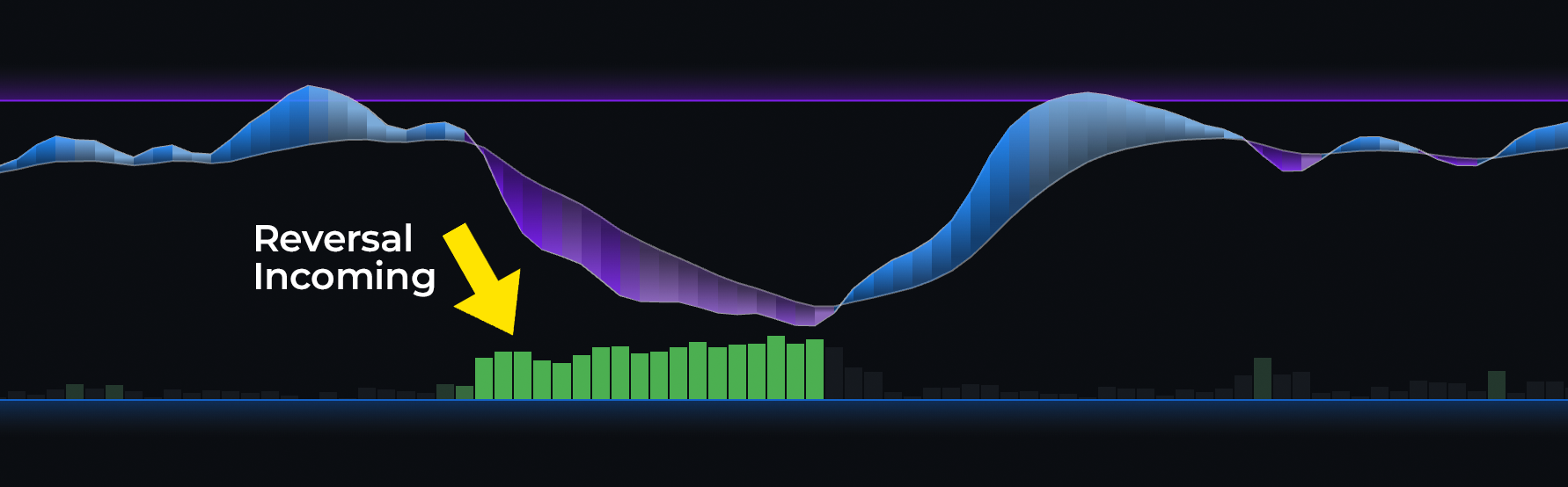

Another key component of the MVP oscillator is the overextended green bars that appear when a market reversal is due.

|

|---|

| Green Bars suggesting the market will soon reverse |

When the green bars appear, users can infer that the market may bounce around this region, making this feature particularly valuable when used in conjunction with other tools from ChartPrime. Looking for these bars can indicate when traders might want to consider dynamic positions. Consider these a warning sign.

Signals

The MVP oscillator also generates signals. These appear when the oscillator becomes overextended and display arrows. These can serve as classical buy or sell signals when used in conjunction with other indicators.

|

|---|

| Signals for Buy/Sell Actions |

Looking for confluence with these signals can be a powerful strategy. For example, in the image above, we see a buy signal accompanied by green bars. This suggests that the market is due for a reversal, which is most likely to be bullish.