Order Blocks

Flagship Order Blocks

The Order Blocks in Market Dynamics represent an innovative approach to classical analysis techniques. These blocks are categorized into three levels:

- Soft: Represents the lowest value, indicating a relatively low number of orders at this level.

- High: Represents a moderate value, suggesting a reasonable number of orders at this level.

- Loud: Represents the highest value, indicating a substantial collection of orders.

|

|---|

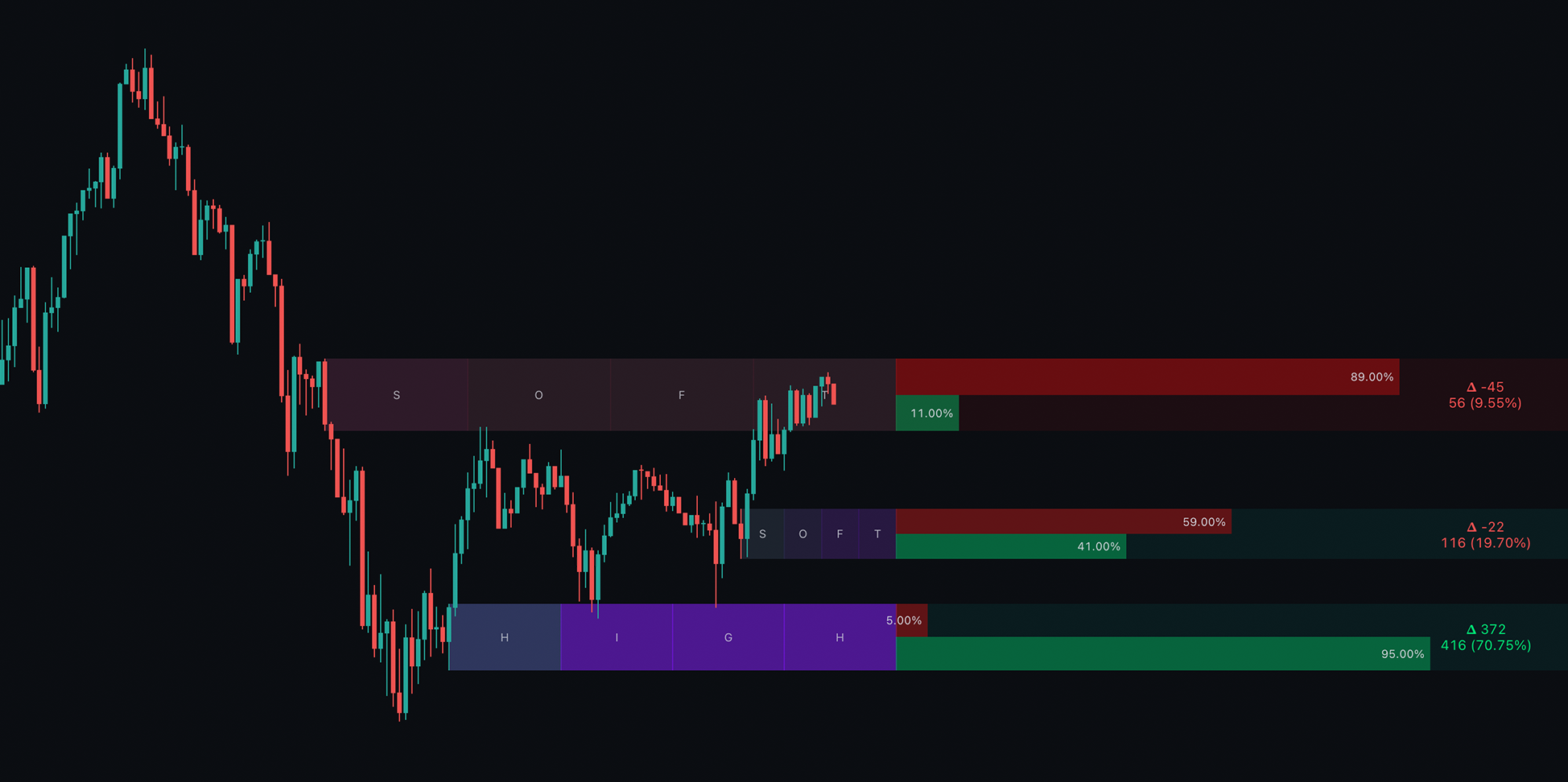

| Order Blocks in chart |

These order blocks are derived from volume analysis of the market, enabling predictions of where large buying or selling orders are placed. Consequently, order blocks often serve as effective support or resistance levels, as well as tools for take-profit (TP) or stop-loss (SL) strategies. Generally, focusing on higher-valued order blocks is advisable, as they tend to be more significant.

Inside the order blocks, you’ll find two key metrics:

Relative % of Volume

Data + Volume

The percentage value represents the volume going into the order block relative to other blocks, summing to 100%. The higher this percentage, the more significant the block. This value is scaled for easy analysis. The volume value indicates the actual volume entering that order block.

|

|---|

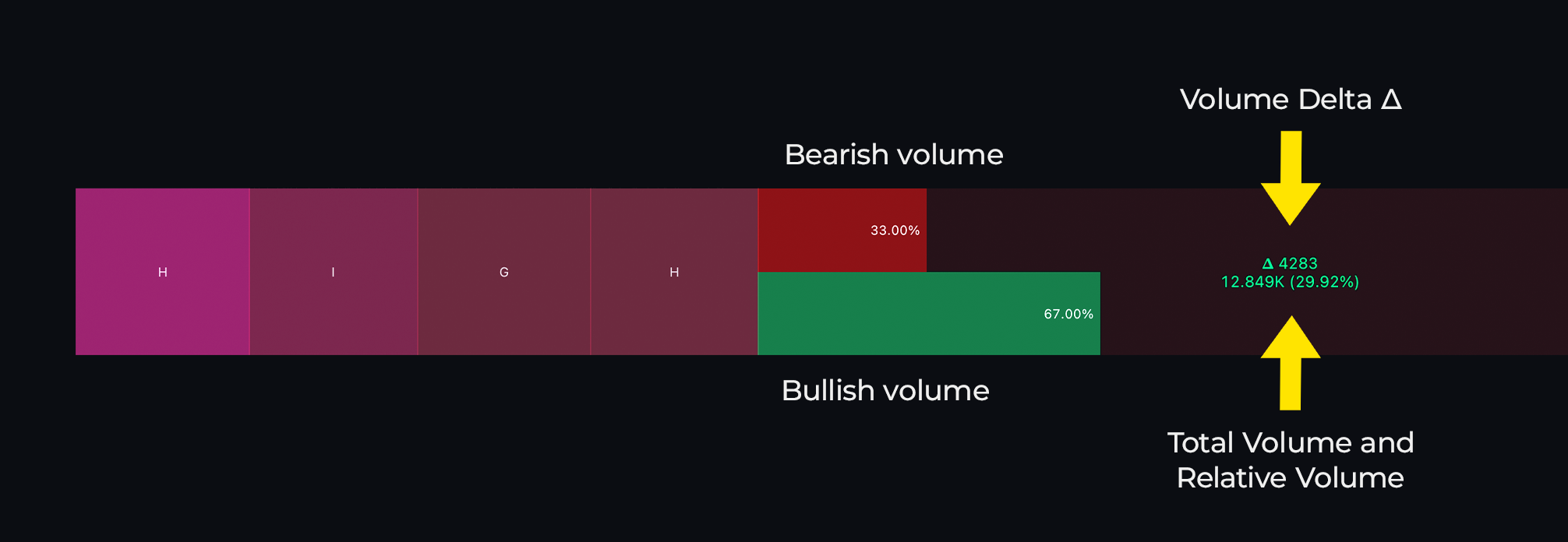

| Order Blocks in detail |

A green and red bar displayed within the Order Block indicates the percentage of bullish versus bearish volume contributing to the calculation of the block. In the example above, these values are clearly labeled. Additionally, a Volume Delta (Δ) shows the difference between bullish and bearish volumes.

How to get the most out of our Order Blocks:

Since Pinescript cannot access order book data, these order blocks are calculated using volume analysis.

Toggles and what they mean

- Show Last: Traders can adjust the number of Order Blocks displayed using the Max OBs setting, which defaults to 4, meaning four order blocks are shown at a time. Users can customize this setting to display more or fewer blocks; a higher value may reveal less significant order blocks, while a lower value emphasizes the more significant ones.

- Dynamics: There are two main types of Order Block generation; Original and Attuned. Original generates more natural blocks with little filtering where as attuned is designed to be cleaner with more regular sized blocks and spacing cleaning up the chart.

- Sensitivity: Users are able to filter the Order Blocks by selected strength and bullish/bearish.

- Timeframe: The MTF (Multi-Timeframe) setting traders to display order blocks from different timeframes. Users can select the desired timeframe from the provided dropdown menu. We generally recommend choosing timeframes at least four times greater than the current timeframe. For instance, if you are on the 1-hour chart, using the 4-hour or higher timeframe is advisable.

- Toggles: Allows you to customise the metrics shown in the block.

To display the order blocks, the asset must have volume data.