Optimizing Your Signals

As previously mentioned on the Trend Signals page, there are two main approaches to optimizing your signals:

1) The "Optimal Tuning" feature, accessible in the settings menu (located at the bottom right of the screen), provides users with a way to refine their trading approach. This tool offers a set of backtested settings that have historically yielded the best outcomes for a particular asset. The primary advantage of this method is the consistency it brings, allowing traders to implement a stable and repeatable strategy. However, its downside is reduced adaptability to rapid market changes, as the algorithm operates on a fixed set of parameters.

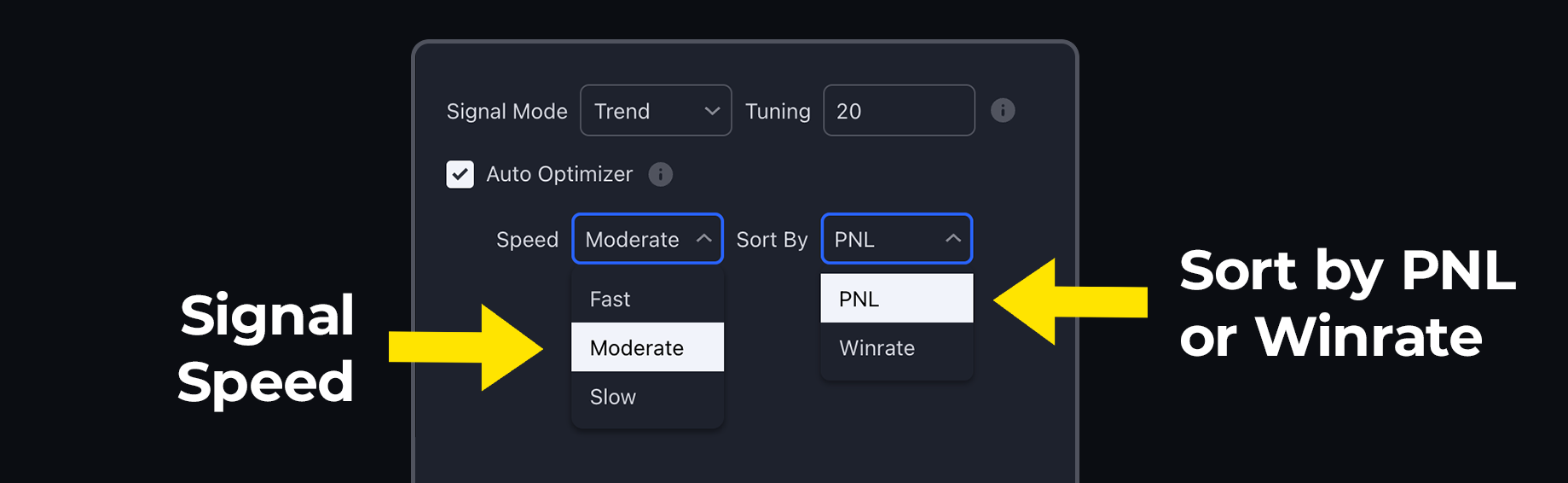

2) Alternatively, the "Auto Optimizer" offers a more fluid and adaptable optimization strategy. When activated, this feature allows the signal generation algorithm to automatically adjust its parameters in response to market conditions, whether they are trending or ranging. Users can control the frequency of adjustments, ranging from low to high. Opting for a high frequency results in more frequent trading signals, which may be preferred by traders looking for more active trading opportunities. Conversely, selecting a low frequency will generate fewer signals, catering to traders who prefer a more conservative approach.

|

|---|

| Optimization options displayed |

When using the Auto Optimizer, users can select the speed of adjustments. This ensures that users can optimize the signals for their desired behavior. For example, a fast speed would optimize signals to be quicker or more frequent, which a scalper might prefer. A slow speed would create less frequent signals, which may be more appropriate for longer-term strategies. Users can also adjust what they are optimizing for, either win rate or profit and loss, providing an extra level of flexibility when optimizing signals.

Just because you have a high win rate does not mean you will achieve high profits. If you won $1 in 9 trades but lost $20 in 1 trade, you would have a 90% win rate but a net loss. Watch out for this classic trap.

Ultimately, the choice between these two optimization methods depends on the trader's individual preferences and style. We recommend experimenting with both techniques to determine which aligns best with their trading objectives before settling on a specific optimization approach. Users may also choose not to optimize in this manner and simply select a setting they prefer to use when in confluence.

If you don’t want to adjust the settings, we offer the Auto Maximizer option. The ChartPrime Auto Maximizer will automatically apply a backtested parameter and display the "best performing signals" on your chart. You can choose between high frequency and low frequency signals here. High frequency results in more frequent signals, while low frequency emphasizes larger market moves by producing fewer signals.

It's important to remember that no matter how optimized signals may be, they will never guarantee profits. We advise against "tail chasing" behaviors in search of the perfect settings. The code will achieve the best possible configurations to assist traders, but using optimized signals as part of a larger system and strategy is always the best approach.

See more detail below: