Tips & Tricks

Setups

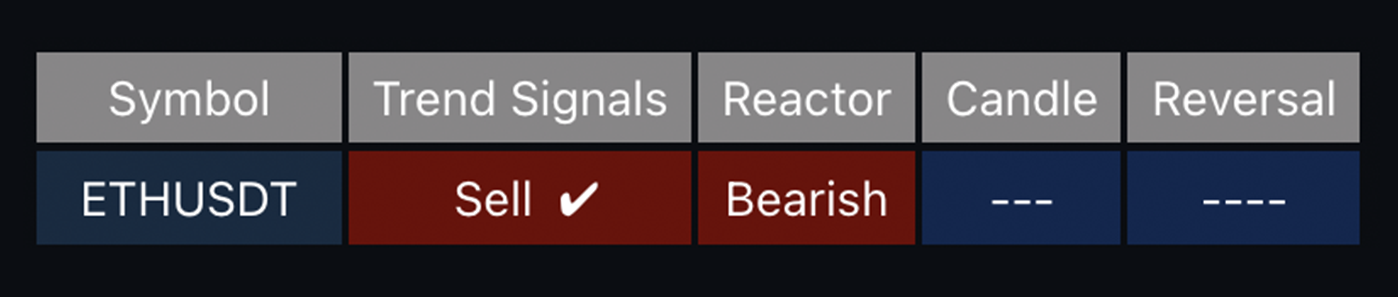

Screeners are best utilized when searching for trade setups. They excel as confluence scanners and should be an essential part of any seasoned trader's arsenal. When looking for a trade setup, it's a good idea to glance at the relevant cells for the upcoming trade. For example, see the image below:

|

|---|

| Confluence between the required cells |

In this image, we see that for ETH, both the Signal and Reactor columns are red. The single tick next to the signal suggests ETH has already been trending downwards and has hit one of the provided take profits. The fact that both cells are red gives us further confidence that the market is in a strong confirmed downtrend.

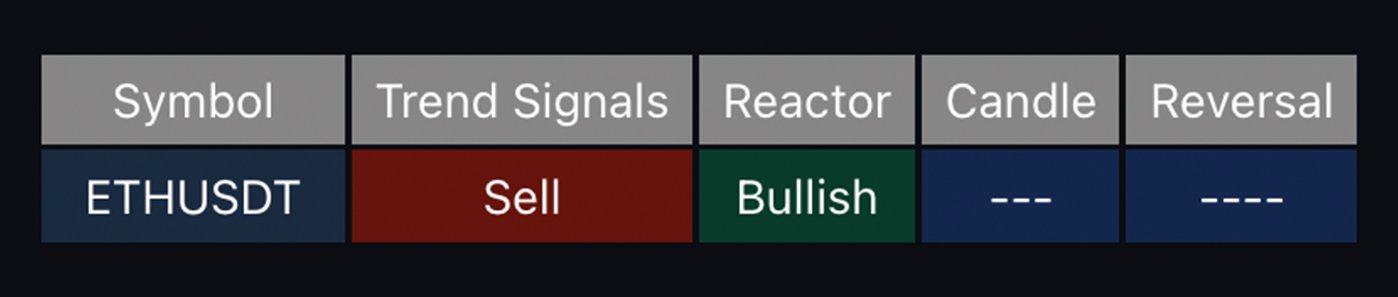

Screeners can also help protect traders against risky trades.

|

|---|

| Indecision between the cells |

In this image, we see that for ETH, the Signal and Reactor columns show different colors and values. The reactor is green, and the signal indicates a sell, suggesting the market is in a period of indecision. Therefore, taking trades in this market could carry higher risks.

Just like in a quiz, going with the majority vote for the answer is usually a good idea. The same applies to indicators—looking at the readings from each distinct tool can be a powerful method.

Exits

Screeners can also help traders detect when markets become overextended and might be more likely to reverse. This insight can facilitate easier exits from trades.

For example, in crypto trading, assets are often correlated with each other or Bitcoin. Observing reversal labels and candlestick patterns appearing in the Bitcoin screener can serve as a leading indicator for taking profits in other trades.

Traders can also use the screener in a more traditional way, focusing solely on their single asset. If a long position is entered and reversal signs along with bearish candlestick patterns are appearing in the screener, it could be an ideal moment to take profit.

Waiting for trends to reverse before taking profits can be dangerous and may leave profits on the table. Remember, profit is profit.

Customize Your Screener

Location: Traders can change the location of the dashboard and adjust its size via the provided settings. The screener can be positioned in the area of the chart as needed, and its size can be modified to suit different trading styles.

Screened Items: If traders do not wish to screen for a certain condition (e.g., not interested in candle patterns), they can toggle the conditions on and off via the Data Settings input. This customization can make the screener cleaner and more tailored for individual traders.

Reducing the number of screened assets can increase the speed of the screener, making your charting experience even faster.